The underground mining industry faces constant demand for efficiency and safety. The choice of the right "Underground Mining Truck" can significantly impact productivity. According to a recent report from Mining Weekly, productivity can increase by 20% when optimal equipment is utilized. This clearly highlights the necessity of selecting the best truck options in 2026.

Industry expert Dr. Emily Clark states, "Investing in advanced underground mining trucks is crucial for enhancing operational efficiency." Her perspective emphasizes the evolving nature of mining operations. While many companies focus on high-capacity trucks, it is vital to consider adaptability and maintenance aspects. The best choices are not always the largest; sometimes, smaller, more versatile options prove beneficial.

The landscape of underground mining is changing rapidly. Companies must analyze their specific needs and examine their fleets critically. Achieving efficiency means more than just acquiring new models; it requires a thoughtful approach to integrating technology and reflecting on existing operations. As selections are made for 2026, thorough research and expert guidance will be necessary to navigate these complex decisions.

As the underground mining industry evolves, technology plays a crucial role in improving truck efficiency. A growing trend is the integration of automation. More mining operations are embracing automated trucks. This reduces human error and enhances safety. The benefit is significant, but implementation complexity remains a challenge. Many companies struggle with the transition.

Electric trucks are gaining traction in underground mining. These vehicles offer lower emissions and reduced noise levels. However, battery life and charging infrastructure can be limiting factors. The development of fast-charging technologies is essential for maximizing efficiency. Companies must invest in research to overcome these obstacles.

Data analytics is another area of focus. Mining trucks equipped with sensors can collect valuable operational data. This data helps identify inefficiencies and optimize performance. Yet, some managers may overlook this information. Lack of training is a barrier to effective use. The emphasis now is on creating a culture that values data and continuous improvement.

When considering the best underground mining trucks, efficiency is key. High-efficiency trucks should have robust engines and advanced hydraulic systems. A powerful engine can ensure better performance on steep terrains, which is common in underground environments. According to a recent industry report, trucks with improved fuel efficiency can save up to 30% on operational costs.

Another essential feature is payload capacity. Trucks capable of handling larger loads reduce the number of trips needed. This directly impacts productivity. Many high-efficiency models can carry between 30 tons and 50 tons without compromising speed. However, it’s crucial to analyze the right balance between load and maneuverability to avoid potential performance issues.

Tip: Regular maintenance is vital. Even the most efficient trucks require upkeep to perform optimally. Check tire conditions and hydraulic systems frequently to ensure longevity and effectiveness. Remember, ensuring operator training can enhance overall efficiency, but the human factor can sometimes cause problems in handling. Investing in efficiency doesn’t end with purchasing the truck. Continuous assessment is necessary for maximum performance.

| Truck Model | Load Capacity (tons) | Fuel Efficiency (L/100km) | Turning Radius (m) | Operating Weight (kg) | Power (HP) |

|---|---|---|---|---|---|

| Model A | 40 | 30 | 6.5 | 12000 | 300 |

| Model B | 50 | 28 | 7.0 | 13500 | 350 |

| Model C | 60 | 25 | 7.5 | 14000 | 400 |

| Model D | 55 | 27 | 8.0 | 15000 | 450 |

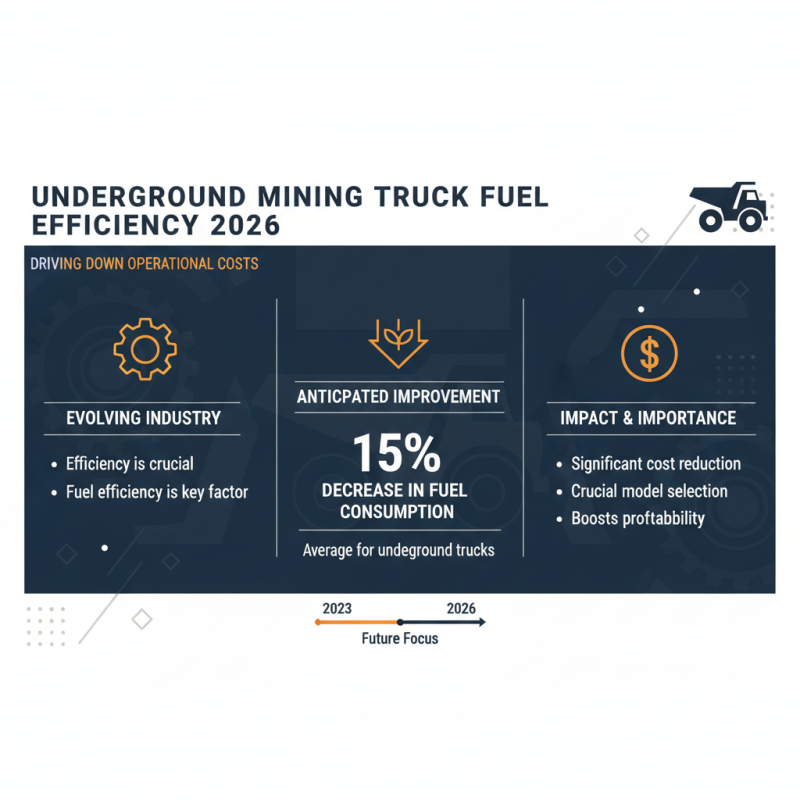

As the underground mining industry continues to evolve, the efficiency of mining trucks is crucial. Recent reports indicate that in 2026, fuel efficiency will become a key factor. The average fuel consumption for underground trucks is expected to decrease by up to 15%. This reduction can significantly cut operational costs, making it vital for companies to choose the right models.

Comparative analyses of the top models show that payload capacity remains a critical element. Most models now offer capacities ranging from 20 to 30 tons. However, not all trucks maintain performance when loaded to capacity. Some trucks struggle to maneuver in tight underground spaces, which can lead to delays. A model with a smaller footprint could outperform larger, heavier trucks in efficiency.

Moreover, maintenance remains a concern. Trucks requiring frequent repairs can disrupt operations. Reports suggest that durability should be a priority when selecting trucks. The average lifespan of an underground mining truck is about ten years, but some models fall short. Therefore, companies must carefully assess the reliability of their choices in terms of both cost and performance to ensure smooth operations underground.

In the world of underground mining, payload capacity and fuel efficiency are crucial. These factors directly affect productivity and operational costs. A truck that carries more material can reduce the number of trips needed. This translates into saving time and lowering labor costs. On the flip side, if the truck consumes too much fuel, it can eat away at those savings. Striking the right balance is key.

Tips: Always consider the terrain. Different trucks perform better in different environments.

Efficiency doesn't just rely on the vehicle. Maintenance plays a huge role. Regular checks can prevent breakdowns. If a truck is frequently in the shop, it’s costing you money. Evaluate how often maintenance is done.

Another aspect worth reflecting on is driver training. Even the most powerful truck can't perform well with an untrained operator. Investment in training can pay off. A skilled driver can optimize fuel use and load handling. The right blend of capacity and efficiency can lead to substantial gains. A well-rounded approach leads to success in mining operations.

As automation and sustainability become focal points in underground mining, innovations are emerging rapidly. A recent report indicated that automated trucks can enhance efficiency by up to 20%. This shift reflects a growing commitment to reducing both operational costs and environmental impact. The incorporation of sensors and AI can now optimize routes in real-time, which minimizes fuel consumption and machinery wear.

Sustainable practices are also gaining traction. For instance, electric underground trucks are touted for their ability to cut emissions significantly. Data from industry studies show that adopting electric vehicles can reduce greenhouse gas emissions by as much as 30%. However, challenges remain. Battery longevity and charging infrastructure are still being developed. Companies must invest in new technologies while considering their long-term feasibility.

Despite these promising advancements, the transition to fully automated and sustainable systems is not without hurdles. Workforce adaptation is crucial. Workers need training to manage new technologies effectively. Moreover, performance in diverse terrains can be unpredictable. Continuous evaluation and feedback loops are necessary to refine processes. The path forward is a mix of innovation and reflection, ensuring that solutions are practical and effective.